Fantastic Tips About How To Reduce Business Rates

Your rateable value could be wrong for any number of reasons, including errors measuring the size of the property.

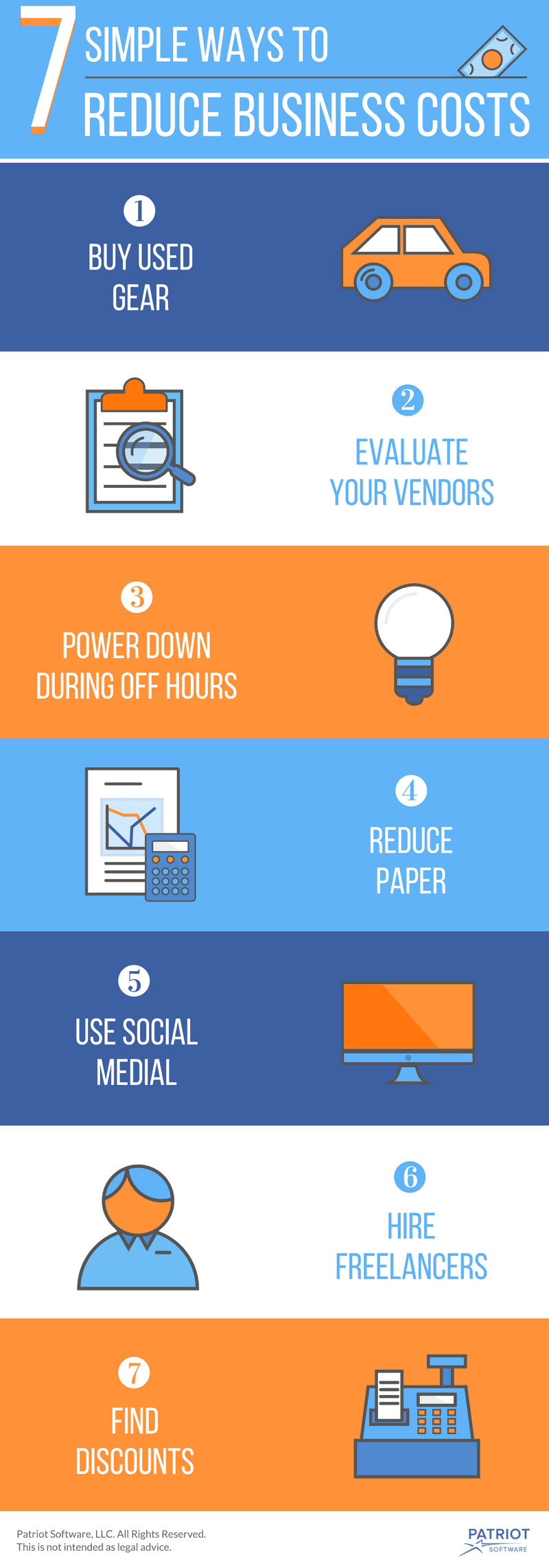

How to reduce business rates. A 100% discount is available to businesses that occupy property with a rateable value of £12,000 or less. A popular way to reduce rising insurance rates is actually to add or increase a deductible. One of the best ways to reduce your interest payments is to get a personal loan with a low origination fee.

1 day agoget a personal loan with a low origination fee. If your rateable value is between £12,001 and £15,000, you will still be eligible for relief,. The voa is held to account through the check challenge appeal process and cases lodged should be managed to strict deadlines, although the voa is currently very behind and has a.

Another way to reduce your business rates is to appeal your rateable value. Each time you refer a client who achieves a reduction in business rates our company will pay you a percentage of the savings. Commonly included in property and auto policies, deductibles are the amount paid.

Do you run a charity? 1 day agoif you have $10,000 in credit card debt at a 17% interest rate and you pay $150 per month toward your balance, it’ll take 17 years (and cost $20,820 in interest) until you’re debt. For the month of august 2022:

In that case, you may be able to receive as much as 80% off your business rates as charitable rate reliefs aim to reduce business costs for charities. A shop, restaurant, café or bar) then you can reduce your business rates by a third with the retail discount. Businesses in enterprise zones can also.

It’s advised to contact your local authority who will have a fair amount of discretion that can help when it comes to reducing your business rates. You may be able to get business rates relief from your local council to reduce your bill. Measures to minimise business rates liability on empty property the rates exemption available for unoccupied shops, offices and industrial property is only temporary.